Tidbits, Trump, S&D Estimates, Brazil & Argentina Crops, Broilers & Ethanol 11/7/24

- Wright team

- Nov 7, 2024

- 6 min read

Highlights

Leaders of foreign countries who sell products to the U.S. markets, are scurrying to prepare to deal with President Trump’s threats of tariffs. The EU leaders are already scheduling a series of meetings to develop plans to “appease” Trump so he will not slap tariffs on their products. Predictions will start to develop around China and the U.S. future trade relationship. China's window to buy U.S. beans will be wide open for the next 80 days.

Just before the CBOT closes today, the Federal Reserve will announce their current opinion of the U.S. economy and probably will announce a change in interest rates. The market expects a reduction of 25 basis points, a quarter of a percent.

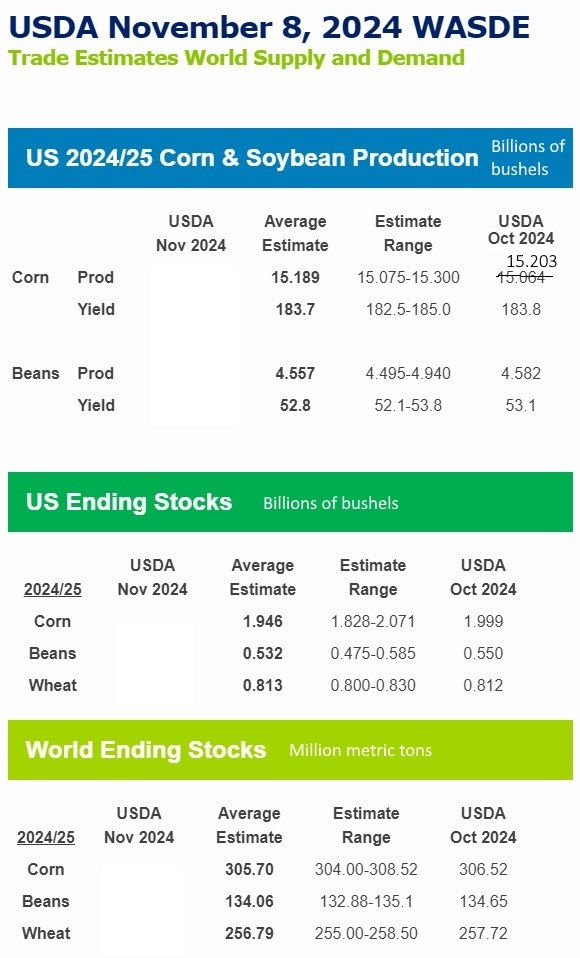

The USDA will release at 11 AM Central tomorrow the November S&D. The chart below is another version for the U.S. and the South American numbers estimates. We corrected an U.S. corn production mistake.

Cargill’s corn syrup plant at Dayton, Ohio notified farmers via text yesterday afternoon they are paying $4.50 for corn delivered in April. That would be 4 over the May. Last April, they were paying 5 under the May. In April 2023, they were paying 40 over the May, which was trading in the $6.50 area, and in April 2022, they were paying even with the May, which was trading in the $7.50 range.

We do not recommend you lock-in the basis at this time for April delivery to any place unless you can get 40 over the May.

Tidbits

U.S. crude oil stockpiles increased by 2.1 million barrels to 427.7 million barrels for the week ending November 1 as exports declined by 1.4 million barrels per day to 2.9 million bpd. Net U.S. crude imports rose by 1.7 million bpd, according to the U.S. Energy Information Administration (EIA). However, West Texas Intermediate crude was roughly flat.

In October 2024, Brazil exported 6.4 million mts (252 million bushels) of corn, a 24% decrease from October 2023, though still above the monthly average. Only 2% of these exports went to China, compared to 41% in October 2023. This indicates that non-China corn exports rose by 25% year-over-year. So far in the 2024 calendar year only 7% of Brazil's corn went to China, down from 27% in the same period in 2023. Overall, total corn exports for 2024 are down 27% from the previous year, but non-China exports have decreased by only 8%. Additionally, Brazil's second corn crop for the 2023/24 season was 12% smaller than the previous season's crop.

Eduardo Vanin reported:

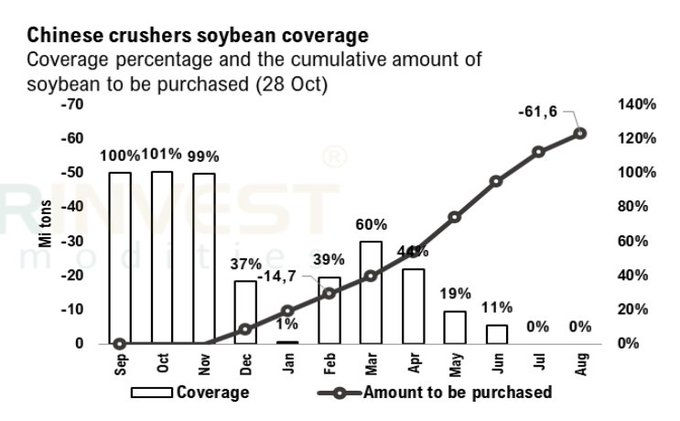

Chinese crushers need to purchase 15 million mts of soybean by the end of February. Brazil might have an additional 1.5-2 million mts for December, 1 million mts for January, and 6-7 million mts to sell to all destinations (70-75% of which is expected to go to China). This implies China still needs 7-8 million mts.

Soybean planting in Brazil surged again with 54% planted as of late last week compared to 51% last year according to AgRural. After a slow start, the situation for planting has improved in the last two weeks: with better soil moisture, germination and emergence has been rapid and uniform and the soybeans are rated in good condition.

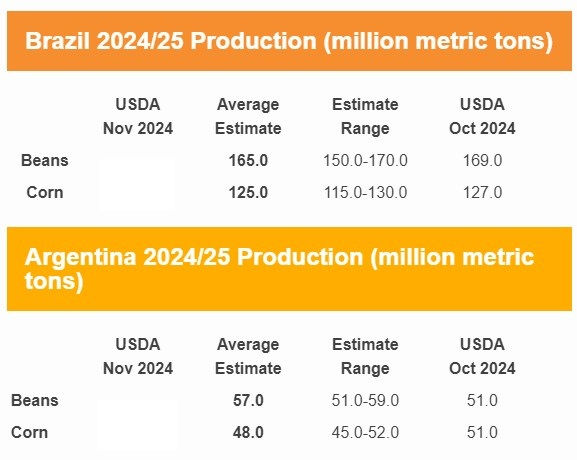

Brazil's 2024/25 soybean acreage is estimated at 115.5 million acres, which is up 2.1% from last season. Production is estimated at 165 million mts, which is up 12 million mts (7.8%) from last season.

CONAB (Brazil’s USDA) will release their November Crop Report on Thursday, November 14, 2024.

Corn in Argentina was 34.5% planted as of late last week, which represented an advance of 5.6% for the week. In the core production areas, the corn is 70-75% planted with 20-50% planted in southern areas and 0% planted in far northern Argentina. The 2024/25 Argentina corn acreage is estimated at 14.8 million acres, which is down approximately 15% from last season.

As farmers in Argentina finish their corn planting, they are switching over to soybeans which were 3.3% planted as of late last week of a total 43.2 million acres expected (up 6.6% from last year). Its acreage may change due to corn areas, as leafhopper pressure is less than anticipated, and that might encourage farmers to plant more late corn and less soybeans.

India's vegetable oil imports are estimated to decline further in the 2024/25 season that started in November, to 15 million metric tons with a boost of domestic production. The previous 2 marketing years imports were 16 and 16.5 million mts. India is the world's biggest veg oil importer, palm oil usually takes 60% of the volume, but its recent high prices motivate buyers to shift to other oils like soybean, sunflower and rapeseed.

Editorial by Roger Wright

Do not think for one minute that the Trump haters are going to let Trump take office without a serious effort to sideline his presidency. There are dozens of high profile and powerful people who broke the law trying to destroy Trump as far back as 2015. They expect, now that Trump will soon be president, he is going to charge them with treason. Maybe Trump is and maybe he isn’t, but they are not going to wait to find out.

As an example, former Chairman of the Joint Chief of Staff, General Mark Milley, recently said he fears being court-martialed for treason if Trump is re-elected because, among other things, he was in direct contact with his Chinese Communist counterpart multiple times from 30 October 2020 until after President Biden was inaugurated, sharing information about the Trump Presidency without the President’s knowledge.

Broilers & Ethanol Update

Last week:

Broiler egg set was up 7% than the same week a year ago.

Broiler egg hatch was up 6% than the same week a year ago.

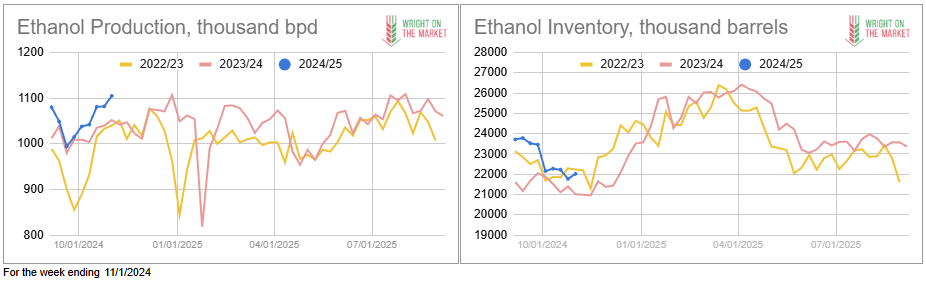

Ethanol production increased this week by 23,000 bpd to 1,105,000 bpd. This is close to the record production figure of 1,109,000 bpd.

Average daily ethanol production:

1,105,000 barrels last week.

1,082,000 barrels the previous week.

1,042,000 barrels the same week a year ago.

1,051,000 barrels the same week two years ago.

Ethanol inventory was 22.020 million barrels compared to 21.771 million barrels the previous week.

Audio Version

Market Data

Prices are as of 2:50 AM ET:

Crude oil is at $71.66, down $0.03

The dollar index is at 104.82 down 0.27

December palm oil is at 4,998 MYR, up 41. The contract high was made today at 5,055 MYR. Palm oil owns 61% and soybean oil owns 14% world market share.

December cotton is at $70.35, up $0.66 per cwt. The contract high was made June, 9th 2022 at $91.38 per cwt. Cotton competes with soybeans and corn for acres.

December natural gas is at $2.758, up 0.011. The contract high was made September, 1st 2022 at $5.627. Natural gas is the primary cost to manufacture nitrogen fertilizer.

December ULSD is at $2.2640 per gallon, down 0.0060. The contract high was made June, 9th 2022 at $2.8058. ULSD stands for Ultra Low Sulfur Diesel.

December Dow Futures is at 43,941, up 40. The contract high was made today at 44,017.

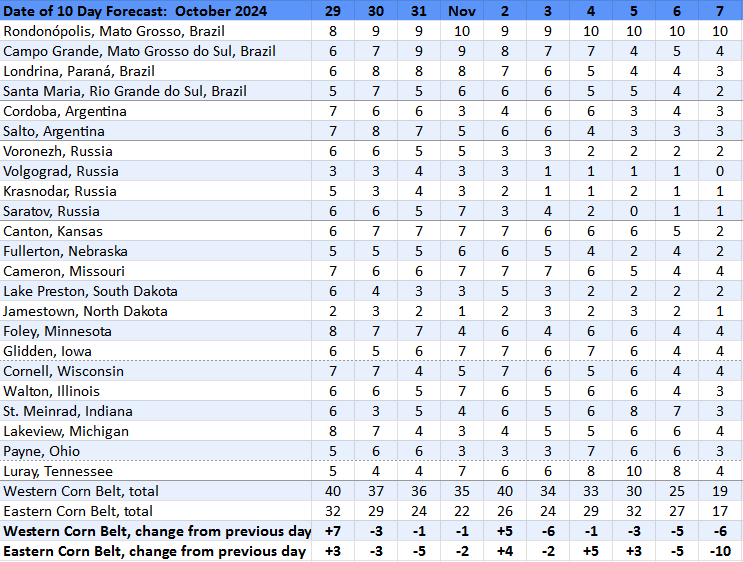

Rain Days Update

The 6 to 10 day forecast updated every day at: https://www.cpc.ncep.noaa.gov/products/predictions/610day/

Explanation of Rain Days

Comments