Tidbits and Market Situation 12/18/24

- Wright team

- Dec 18, 2024

- 5 min read

Tidbits

If you have beans on a January basis contract, get them rolled today to March. This market may go inverted (January premium to March), but the downside risk of the January to March carry increasing 4 to 15¢ far exceeds the upside potential with world carryover 119 day supply. If you are tempted to get greedy: that spread was 15¢ six weeks ago. Last year, that spread got to 3¾¢ carry on 27 December with 107 day world carryover; it reached 4¾¢ two years ago on 30 December with a 101 days world carryover.

After trading slightly higher to lower all night, about the time the substantial export sales were announced yesterday morning, corn, wheat, and beans began a decided down trend for the day. There was no logical reason for any of the three commodities to be so weak.

The U.S. dollar was steady to weaker, the weather forecast was about the same for all crop areas of the world with continued rain in Northern Brazil where most of Brazil’s beans are grown and less rain and more heat in Argentina over the next two weeks, which will not be good for their corn and beans.

Dr. Michael Cordonnier left his Brazilian corn production unchanged at 125 million mts (USDA 127) and Brazil’s bean production unchanged 170 million mts (USDA 169). He increased his Argentine corn production estimate by 1 million mts to 49.0 million (USDA 51), but lowered his Argentine bean production by 2 million mts to 55 million (USDA 51).

SovEcon (Andrey Sizov) lowered Russia’s 2025 wheat production by 3 million mts to 78.7 million with their winter wheat production reduced 3.6 million mts to 50.7 million. Last week, the Russia winter wheat crop condition was the poorest ever.

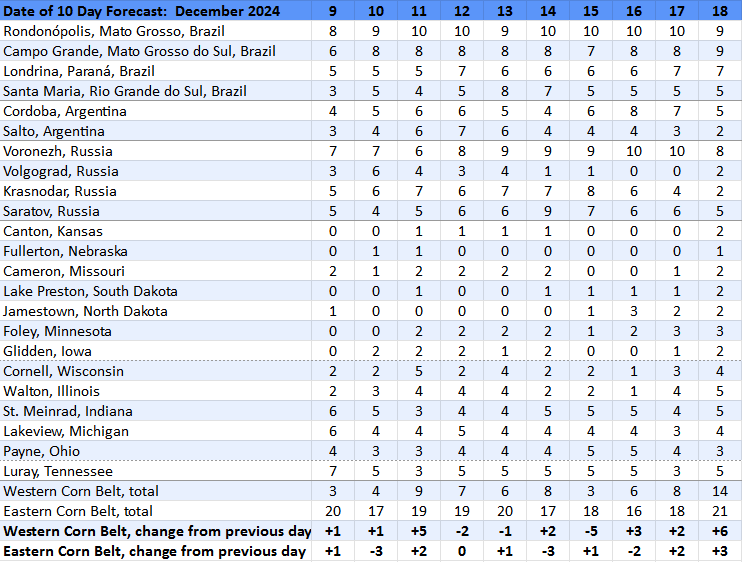

We track rain days for four locations in Russia where most of their wheat is grown. Voronezh is too wet and yesterday’s ten day forecast predicted ten days of rain. Volvograd is dry and its ten day forecast yesterday had no rain in the 10 day forecast. Russia is, by far, the world’s leading exporter of wheat.

Yesterday morning, the USDA announced the sale of:

170,400 mts of old crop corn to Mexico

187,000 mts of old crop soybeans to Spain

132,000 mts of cold crop soybeans to unknown

Japan issued a tender of 77,220 mts of milling wheat with 55,420 mts of it coming from the U.S. and the rest from Australia.

South Korea bought 66,000 mts of optional origin corn. For the next three to four months, the U.S. has the cheapest corn.

Recent rains in the Mid-south and Ohio River Valley has been enough to allow for full drafts on barges on the lower Mississippi through December and tow sizes should be back to normal through the holidays.

The head of Russia’s Nuclear, Biological, and Chemical Defense Forces, Lieutenant General Igor Kirillov, was killed on Dec. 17 by a bomb hidden in a scooter near an apartment block in Moscow. Reuters reported that Ukraine’s intelligence agency confirmed it made the hit.

When any country has a general assassinated, there will be severe consequences and President Putin will make sure it happens. This is a major escalation of the political and military conflict in the “Bread Basket of the World.” It makes no sense that wheat was so weak yesterday.

So, why were corn, wheat, and beans so weak yesterday. The excuse for lower trade was good weather in South America. That is not new news. It has been good weather in South America since mid-October when the rainy season started. We agree, good weather from now through January will make a good soybean crop, but that has been expected for two months. Argentina’s two week forecast did turn a bit warmer and drier yesterday, which is not terrible at this point, but not good for those crops.

What is positive:

Corn, beans, and soft red winter wheat did recover somewhat late in the day and settled well off their lows.

Corn, beans, and soft red winter wheat futures were removing carry (return to storage) all day. January and March beans traded within ¾¢ of each other and settled at 2¢ of carry, losing 2¢ of carry on the day. March corn gained a quarter cent on May corn. March soft red winter wheat gained 1½¢ on the May contract. When grain markets are lower, the carry from month to month usually, almost always, increases to provide incentive for the owners of the grain to keep storing it.

So what does it mean when a market loses carry on a down day? It means something is way out of whack. The futures market traders are not trading the fundamentals of the market, which are bullish because the commercial traders (merchandisers) are telling us they do not want the grain to remain in storage.

Who do you think are right, the speculators or commercials?

While soybeans did make a new low for the January contract, what is important to technicians is that January beans did not exceed the $9.68 support which was left over on a continuation chart by the November beans contract on October 17.

Audio Version

Market Data

Prices are as of 10:30 PM ET:

Crude oil is at $70.11, up $0.03

The dollar index is at 106.91, down 0.04

July palm oil is at 4,279 MYR, down 73. The contract high was made November, 11th 2024 at 4,576 MYR. Palm oil owns 61% and soybean oil owns 14% world market share.

July cotton is at $70.75, up $0.09 per cwt. The contract high was made April, 3rd 2024 at $85.63 per cwt. Cotton competes with soybeans and corn for acres.

July natural gas is at $3.235, up 0.025. The contract high was made November, 21st 2022 at $4.364. Natural gas is the primary cost to manufacture nitrogen fertilizer.

July ULSD is at $2.1867 per gallon, down 0.0270. The contract high was made January, 23rd 2023 at $2.6729. ULSD stands for Ultra Low Sulfur Diesel.

March Dow Futures is at 44,035, up 68. The contract high was made December, 4th 2024 at 45,642.

Rain Days Update

The 6 to 10 day forecast updated every day at: https://www.cpc.ncep.noaa.gov/products/predictions/610day/

Explanation of Rain Days

Komentarze